Housekeeping: Good Morning.

Food For Thought: Bretton Woods Three is a process, not an event

Today:

Macro Funds Are Back, Miners on Deck

Premium: MSA on miners, and Apollo on Tomorrow’s Jobs report

Yesterday’s Activity:

US equities advanced on Wednesday after two consecutive days of losses.

Market Commentary: Macro is Back, Miners on Deck

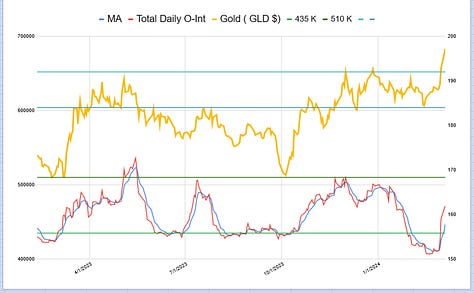

Gold- New All time Highs/ New ATHs

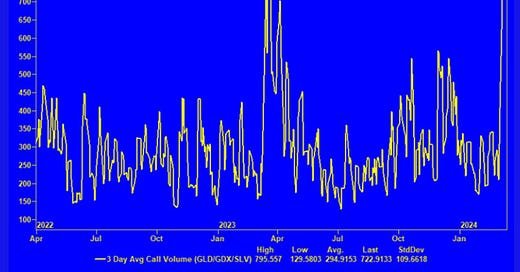

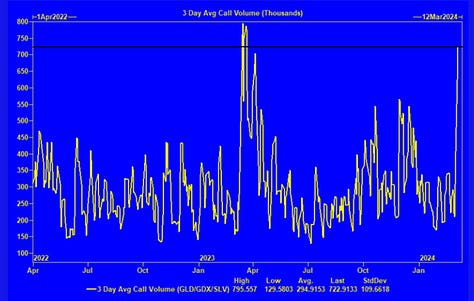

Silver- Plays catch up/ canary of OB in gold now

Miners- Int’l concerns, domestic fund mgrs, and delayed gratification

Oil- strong yesterday, weak today

BTC/ETH- orderly re-rally

Stocks- breather

Bonds- stronger again

Dollar- mixedMarket News:

"Federal Reserve Chair Jerome Powell on Wednesday reiterated that he expects interest rates to start coming down this year, but is not ready yet to say when. Powell said policymakers remain attentive to the risks that inflation poses and don’t want to ease up too quickly." Source: CNBC

"Wall Street banks are on the cusp of a sweeping regulatory victory after Federal Reserve Chair Jerome Powell signaled officials would scale back plans to make them hold more capital. It immediately threw into doubt a signature Biden-era regulatory effort." Source: Bloomberg

"A Chinese man who worked as a software engineer at Google in California has been charged by the US justice department with stealing artificial intelligence trade secrets from the technology giant while covertly working for rival China-based companies." Source: FT

"New York Community Bancorp is raising more than $1 billion from a group of investors including former Treasury Secretary Steven Mnuchin, in a bid to shore up confidence in the troubled regional lender... Source: WSJ

"Foot Locker reported a holiday-quarter loss on Wednesday and its shares plunged nearly 30%. Source: CNBC

"The Securities and Exchange Commission approved new requirements that public companies disclose their greenhouse-gas emissions, but dropped a key provision that was fiercely opposed by business groups." Source: WSJ

GEOPOLITICS

Israel Broadcasting Corp. cited sources stating that Washington is pushing for an agreement on a hostage deal

US military said it conducted self-defence strikes against two unmanned aerial vehicles in Yemen, according to Reuters.

Chinese Foreign Minister Wang said they resolutely oppose all acts of power and bullying, while it will vigorously safeguard sovereignty, security, and development of the country. Wang commented that maintaining and developing Sino-Russian relations is a strategic choice

more1

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, MARCH 412:00 pm Philadelphia Fed President Tom HarkerTUESDAY, MARCH 510:00 am ISM services Feb.WEDNESDAY, MARCH 6 10:00 am Fed Chair testifies to Congress.

THURSDAY, MARCH 7 Fed Chair Jerome Powell testifies to Congress

Initial jobless claims March 2 218,000 215,000 8:30 am U.S. productivity (revision) Q4 3.1% 3.2% 8:30 am U.S. trade balance, 3pm Credit

FRIDAY, MARCH 8 U.S. NFP unemployment rate 2

Premium Attached:

NFP Analysis