Housekeeping: Good Morning.

“The reset is a process, not an event”

Topic:

Citi Expects Gold To Crack $3,000, Industrials to Outperform

Market Analysis:

After a remarkable three-year rally, Citi is calling time on gold's bull market. In their latest commodities outlook, analysts project that an improving macroeconomic environment — fueled by fiscal and monetary stimulus — will shift capital out of gold and back into cyclical assets. The forecast suggests a gradual reversion below the $3,000/oz threshold by late 2026, with prices falling as low as $2,500/oz.

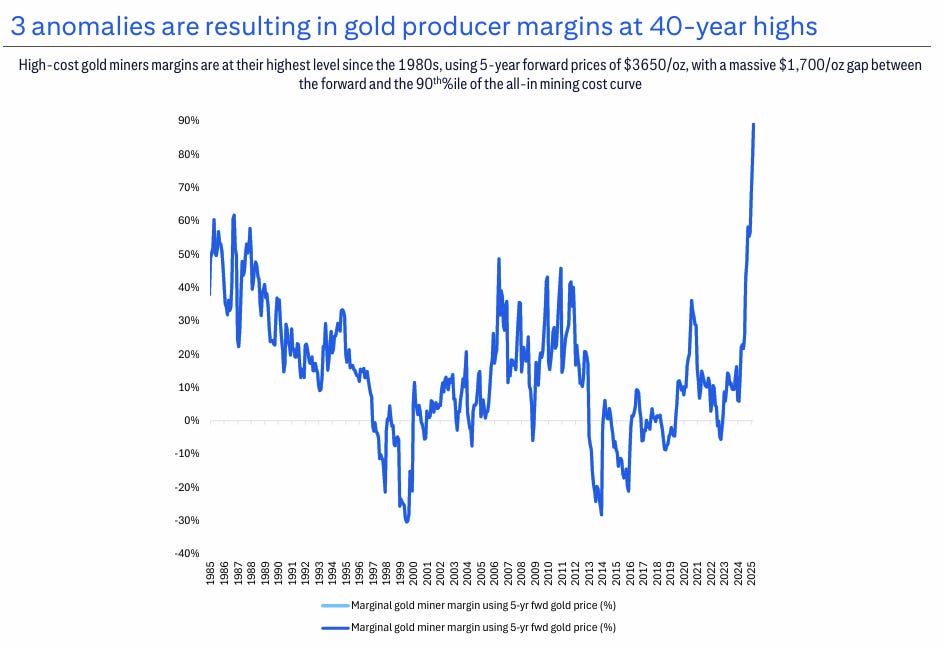

Gold Miners: Citi Makes The Fundamental Case

Housekeeping: This report is probably the best of the bunch here from a macro POV. They argue—and we write up— at the end of the day, it is time for Gold miners to begin to track gold price just like oil and copper producers do. We would add, stock portfolio managers like fundamentally-driven market analogs with a target.. especially when their MAG 7 stocks are cracking

Citi expects additional rate cuts ahead and believes these will prompt sidelined capital to flow into the broader economy rather than into gold, while also suggesting that geopolitical risks are nearing their peak; Goldman, however, pushed back in their own analysis, reaffirming their position—more on that this weekend, and full context is provided in the attached voice note.

Full analysis in the Premium post Audio: Citi Sees Gold’s “Last Hurrah” as Growth Outlook Improves.

Related Posts:

Coming Soon:

Data on Deck: Fed Week

MONDAY, JUNE 16 8:30 am Empire State manufacturing

TUESDAY, JUNE 178:30 am U.S. retail sales

WEDNESDAY, JUNE 18 8:30 am Housing starts, 2:00 pm FOMC rate decision

THURSDAY, JUNE 19 None scheduled, Juneteenth holiday

FRIDAY, JUNE 20 8:30 am Philadelphia Fed survey

Full calendar1

Summary and Final Market Check…

MONDAY, JUNE 168:30 amEmpire State manufacturing surveyJune-6.0-9.2

TUESDAY, JUNE 178:30 amU.S. retail salesMay-0.6%0.1%8:30 amRetail sales minus autosMay0.2%0.1%8:30 amImport price indexMay-0.2%0.1%8:30 amImport price index minus fuelMay--0.4%9:15 amIndustrial productionMay-0.1%0.0%9:15 amCapacity utilizationMay77.7%77.7%10:00 amBusiness inventoriesApril0.0%0.1%10:00 amHome builder confidence indexJune3634

WEDNESDAY, JUNE 188:30 amHousing startsMay1.37 million1.36 million8:30 amBuilding permitsMay1.44 million1.41 million8:30 amInitial jobless claimsJune 14250,000248,0002:00 pmFOMC interest-rate decision2:30 pmFed Chair Powell press conference

THURSDAY, JUNE 19None scheduled, Juneteenth holiday

FRIDAY, JUNE 208:30 amPhiladelphia Fed manufacturing surveyJune-1.0%-4.010:00 amU.S. leading economic indicatorsMay-0.1%-1.0%

Share this post