Weekly: Biden's SOTU About Rebuilding, Tax, Spending, and Chronic Inflation

MorningStar on Mining Mergers

Housekeeping: Am proud to announce GF is involved with a new twitter account for fun1 called Bullion & Boobs. .. which has Gold/Silver insights and is easy on the eyes. (PG-13) please visit and say hi in your travels…

SECTIONS

Market Summary— Rebuild, Tax, Spend, Subsidize

Research— GS, Barclays, BOA, GF

Week’s Analysis/Podcasts— Gold, Oil, Financial Repression

Charts— PM, PGM, Energy, FX

Calendar— CPI, Retail Sales, PPI

Technicals— GC, CL, BTC, SPX

Zen Moment— Marilyn and Sophia

Full Analysis— Miners, Silver, Hartnett, Oil, TiPS

1. Market Summary

Two Friday’s ago we got a very strong NFP number which sparked a hawkish bond market response we suggested would spill over into equities this past week. The analogy was “Put a fork in it… or let it bake a little more” , but don’t get married to bullish moves.

Both of those choices occurred. The first half of the week markets were very volatile with a tiny positive trajectory. In the second half risk-based markets sold-off rather decidedly.

There was pain for bond and stock bulls with all the US major equity indices in the red on the week, led by a puke in Small Caps and Big-Tech. The Dow benefited somewhat from rotation out of tech and into the classics, like Energy and Military stocks.

Tech was mixed, but decidedly weaker in the last half of the week with MSFT doing well in light of its AI iterations while GOOG got slammed on bad presentation of its AI.

Gold: Post last week’s 2 day pummeling, Gold did selloff again this week, but not like it could have. We watch and wait.

Sector/Technicals

Energy revitalized on multiple macro good news events like the SOTU

Pharma finally bounced after weeks of selling.

Aerospace/Military did quite well, perhaps on back of SOTU also

Commodities:

Dollar ended the week modestly higher, holding its gains from last Friday's payrolls print

Gold extended last week's losses, PGMs were horrible

Grains did very well

Oil prices rebounded significantly this week with WTI back above $80

Bonds:

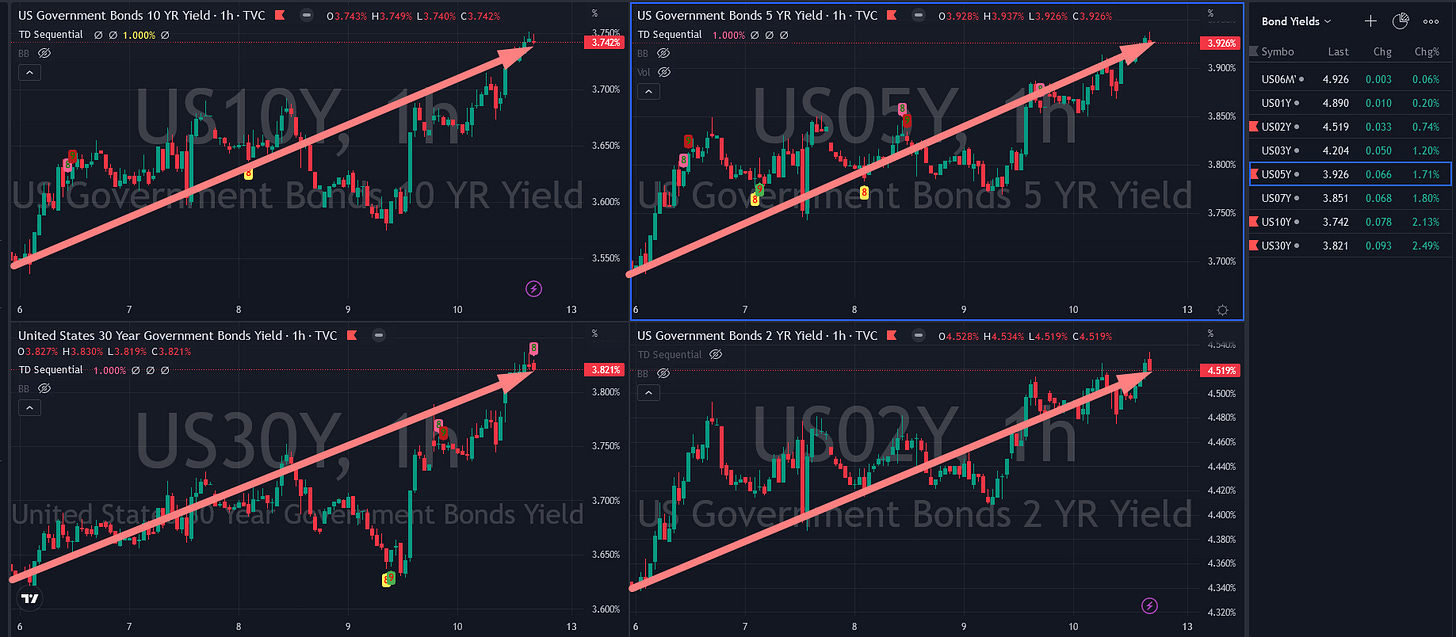

Bonds did poorly this week with yields rising almost uniformly

Crypto:

Crypto did poorly, partly in sympathy with the tech selloff, partly from anxiety from SEC announcements.

Bitcoin tumbled this week after last week's surge, breaking back below $22k.

2. Research:

GoldFix: Biden's SOTU About Rebuilding, Tax, Spending, and Chronic Inflation

Hartnett, a lot of good equity GS***, Barclays on TiPS, Oil

Metals: MorningStar Mining Merger. HW Gold**, Silver institute, Mining Earnings**

CONTINUES AT BOTTOM…

3. Week’s Analysis/Podcasts:

"Gold may be overbought, but who's going to sell?" | Market Rundown

Unlimited Tether issuance to one whale may be artificially boosting BTC

Escobar: The Big Stiff - Russia-Iran Dump The Dollar And Bust US Sanctions

Another Big Week For Central Bank Digital Currencies (CBDCs)

Powell's Speech Tell Us The 1970's Style Slow Bleed is Officially Back