Housekeeping: Good Morning.

“This is part of the process ”

Today

Discussion: What is going on?

Premium: Daily News, ING Commodities

Later today: What a bear market looks like using 1987 and 2000 analogs

Analysis:

What Happened with Silver Last Night?

China came back form holiday and bought a lot of it. They bought gold as well, But Silver was really bought in high volumes. China bought the dip. China’s OTC trading system for the Shanghai Futures Exchange reflected massive buying of Silver on the open scooping up the dip last night

What is happening to markets?

For decades, Wall street has been rewarded for being irresponsible. Now they are paying for it. Little consolation for your own portfolio, but that is what is happening. Financialization is shrinking permanently. As supply chains arebeingreshored, so are global payment chains. This the reset. Trump is just ripping the bandaid off. He did it. Trump is who he (and we) said he was, a classic corporatist….too many people didn’t believe it-personally, we do not fear what was done. We fear if the administration loses confidence in what was done, adnthat is very possible. Overplaying his hand in coming negotations, or backing off due to party support dropping.. These are big risks see *Special Note: This is the Economic Reset

What do I do?

If you are asking anyone this question, including yourself, cut it in half, reassess, and know you will be miserable either way, but you are no longer risking your sanity and your net worth on a coin flip. The next 1000 points are a coin flip

I’m thinking about buying, should I?

If you are asking anyone, do 1/2 half, see above

What does today’s price action mean?

It’s extension of Friday. Margin calls on the opening, a little hope entered the market, and China also began buying metals.- see Standard Charter: Gold Sold To Cover Biggest Margin Calls Since Covid

What about China? China is back, and if they buy metals, then their banks have been instructed to, and that means their resolve is strong for now

What changes this for the better?- stimulus, negotiation, levels, and indicators- See Our Hartnet walkthrough

What makes this worse? Biggest fear, foreign sovereigns start taking all their money out of the US. If that happens, you are on apath ot global recession and great depression risk. Otherwise it’s painful, normal market behavior. see China Retaliates— What it Means

What does that look like? Stocks lower, Dollar weaker, and bonds start to drop. Simply put, as long as the USD and Bonds move opposite directions, things are functioning. If that stops, it removes Powell’s ability to do anything be it cut or raise.

Are we in a bear market?- Yes

What does a protracted bear market look like?- Look for that later today

Did tariffs cause the great depression? Over our paygrade, but not likely in isolation. Tariffs plus policy reaction errors to tariffs cause depressions as we had back then. Is this the first ingredient? Yes.. but far from the scenarios in 1931 and Hartnett agrees. 1

What do Gold and Silver look like when this is over?

Over in the the short term…If Trump and Xi sit down to talk, that is very bearish for Gold, near fatal for leveraged longs in the short and perhaps intermediate term. But long term, not fatal. Tariff ceasefire causes longs to sell some. But the world is not going to reglobalize. Big dip. But discussion is not end of war. And end of war, is not even end of war now.

If this is met with the correct policy choices, and no tartiff ceasefire— bullish gold, silver and stocks. if this is met with bad policy choices, bullish Gold, bearish stocks, bonds, and the USD. Monetary solutios are bullish Gold, fiscal spending solutions are less bullish gold if properly targeted. All errors are bullish gold to varying degrees- See Our Hartnett walkthrough

Good Luck…

Featured:

plus what signs hes looking for to tell him this may be ending

someone tried to run in the shorts, our post mortem analysis details how

margin calls everywhere

this is where we are now, Trump’s approach may fail, he may fold his cards, but this is what has to happen we explain why going back to the 1970s

back from holiday

Markets Recap:

Friday: Wall Street slumped as broad-based U.S. tariffs triggered retaliatory actions from global counterparts, intensifying trade tensions and heightening recession concerns. Treasury yields were also in the red. The dollar gained after Fed Chair Jerome Powell adopted a cautious stance on future monetary policy. Oil prices tumbled on demand concerns, while gold fell as investors sold off the bullion to cover losses in broader markets.

Market News:

Stocks slump again after China fires back in trade war with tariffs on US goods

Trump extends TikTok sale deadline by 75 days, vows to work with China

Stellantis extends employee discount to public as tariffs drive car sales

Meta nears release of new AI model Llama 4 this month, the Information

Wall Street searches for elusive signs that market bottom reached

Tesla investors brace for another year of sales decline as Musk backlash grows

FOCUS-Trump layoffs begin to erode FDA drug review system

Full stories and more at bottom

Geopolitics:

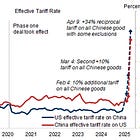

Tariff-mageddon

Taiwan risk.. MORE ON THAT LATER

Data on Deck: CPI/ PPI/ FOMC Minutes

MONDAY, APRIL 7 Consumer credit

TUESDAY, APRIL 8 NFIB optimism index

WEDNESDAY, APRIL Minutes of Fed's March FOMC meeting

THURSDAY, APRIL 10 CPI Monthly U.S. federal budget

FRIDAY, APRIL 11 PPI year over year3.3%2

Summary and Final Market Check