Housekeeping: Good Morning.

“The reset is a process, not an event.”

Today

Discussion 1: Trump’s Riyadh Accord

Discussion 2: What it Means

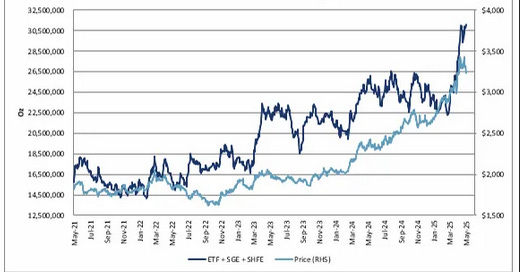

Premium: Comex Deathwatch in Charts

Analysis:

Trump's Riyadh Accord

In Riyadh, the United States and Saudi Arabia finalized what is being described as the largest defense sales agreement in U.S. history—valued at nearly $142 billion—as part of a broader $600 billion investment package. The deal, signed by President Donald J. Trump and Saudi Crown Prince Mohammed bin Salman, marks a significant capital infusion into U.S. strategic sectors.

U.S.-Saudi Pact Delivers Record $142 Billion in Defense Sales, $600 Billion in Investment Commitments

U.S.-Saudi Pact Delivers Record $142 Billion in Defense Sales, $600 Billion in Investment Commitments

Initial projects tied to the agreement span several high-priority areas, including defense, energy, artificial intelligence, infrastructure, healthcare, and technology. According to the fact sheet, the first tranche of deals “strengthen our energy security, defense industry, technology leadership, and access to global infrastructure and critical minerals.”

What it Means

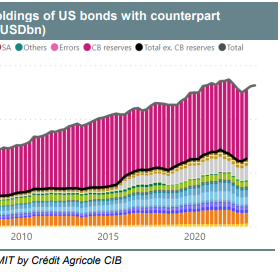

If the United States wishes to maintain even a fraction of its current standard of living over the next 50 years, it must confront two facts: it needs to produce more and find new buyers for its debt. Since the 1970s, the U.S. has relied heavily on the dollar’s reserve status and the recycling of foreign capital through Treasury purchases. That model is now exhausted. We wrote extensively on this in 2024 in “We Will Buy our Own Bonds Now”

Yesterday’s announcement that Saudi Arabia will invest directly in U.S. LNG infrastructure marks a critical milestone in America's effort to address its structural debt issues, restore industrial capacity, and reassert its standing on the global stage.

We Will Buy Our Own Bonds Now

The US features a large Capital Accounts deficit, driven by a structural trade deficit [We spend too much] and despite a positive income balance. In other words, the US is structurally living beyond its means.

Why so excited? Because the administration has not lost the plot. And having secured an anchor tenant in The US new economy, dominoes should begin to fall in Europe, Russia, and soon China. There are plenty of caveats here. But the main plot is being honored

Comex Deathwatch Charts in Premium at Bottom…

Data on Deck: CPI/ PPI/ Retail Sales

WEDNESDAY, MAY 14- Lots of Fed Speakers1

Related Posts:

Summary and Final Market Check…