Housekeeping: Good Morning.

Today:

Premium Analysis: Creepy Rate Cut

News: Hartnett and more

Premium Analysis: Creepy Rate Cut

The last time Fed Cut 50bps was September 18th as well… in 2007

Champagne and Cookies…

Initial reaction was good. But then…

Zooming Out on Stocks versus Gold after the last 50bps cut…

H/T Not Your Advisor post in footnote1

Which brings us to Michael Hartnett’s analysis

News Analysis: Hartnett Weighs in

Hartnett: The 50 BPS Panic Cut

Story: Hartnett: Why The Panic Cut Jerome?

Wall St loves “panic cuts” when [there’s] no panic

Powell cut was to rescue small biz and prevent them from too many layoffs; no other reason makes sense to him. Hence the title.

Good chance inflation will mutate from Wall street to main street

CoT Analysis: Max Positioning

Story: Big Funds took FOMC profits: Bigger ones Bought

Banks are at their ATH short positions with OI not near its ATHs yet.

Banks continue to show almost no option exposure

Net Fund positions are now over 55% of total OI which is higher than the Covid peak.

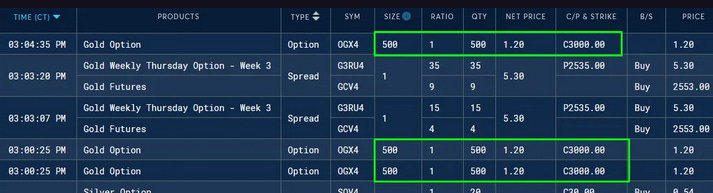

Lost in the Shuffle on Fed Day $3,000 Strike Trades Size

Story: $3,000 Strike Trades Size Post Close on Fed Day

At 4pm after the Fed announcement and GLD close and after the market had washed out on profittaking a significant chunk of Gold $3000 calls traded OTC. We put it in context.

Equity Recap:

US equities were mixed on Friday after the Fed cut near-term rates by 50 bps on Wednesday. Large caps bested small caps: S&P 500 (-0.19%) vs. Russell 2000 (-1.10%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.21% and 0.99% respectively.

Market News: Manufacturing manifests

"Two chip-making giants have discussed building huge factory complexes in the United Arab Emirates that could transform the industry in the coming years and become a cornerstone for artificial-intelligence investments in the Middle East. WSJ

"Apollo Global Management has offered to make a multibillion-dollar investment in Intel... in a move that would be a vote of confidence in the chipmaker’s turnaround strategy. Bloomberg

"Chipmaker Qualcomm approached its struggling rival Intel about a potential takeover in recent days..: FT

"Boeing machinists on the picket lines said they have saved money for the strike and plan to pick up temporary jobs to make ends meet. CNBC

"US banks made a $1tn windfall from the Federal Reserve’s two-and-a-half-year era of high interest rates: FT

Politics/Geopolitics: Gov’t Shutodwn Circus Begins

"Israel and Hezbollah accelerated their cross-border attacks overnight into Sunday with their leaders exchanging saber-rattling threats in a rapidly deteriorating situation that has the adversaries as close to full-out war as they have been in their nearly yearlong conflict." Source: WSJ

US House Republicans unveil three-month stopgap bill to avert a government shutdown which would fund the government through December 20th and omits changes to voter registration that Trump had called for.

Harris accepted a CNN debate invitation and challenged former President Trump to a debate although Trump rejected the offer and said it was 'too late' for another debate.

Data on Deck: Refocus on Inflation Risks

Now that the cuts are in and the recession debate will become academic as stocks have their restored liquidity, focus will again return to inflation risks

MONDAY, SEPT. 23 PMI Sept

TUESDAY, SEPT. 24 Case-Shiller home price index (20 cities)

WEDNESDAY, SEPT. 25 New home sales Aug

THURSDAY, SEPT. 26 GDP everyone speaks

FRIDAY, SEPT. 27 8:30 PCE index .2

Premium:

***DO NOT SHARE THIS***