Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: FOMC Day

Premium: Rabo “Slowdown”

Discussion: Hawkish Cut

Goldman’s Take:

“The FOMC is likely to lower the target range for the fed funds rate by 25bp to 4.25-4.5% on Wednesday. We expect the main message of the December meeting to be that the FOMC anticipates that it will likely slow the pace of rate cuts going forward, and we have revised our forecast for 2025 to eliminate a cut in January. We continue to expect cuts in March, June, and September next year, and now expect a slightly higher terminal rate of 3.5-3.75%.” ...

Rabobank’s Bottom line:

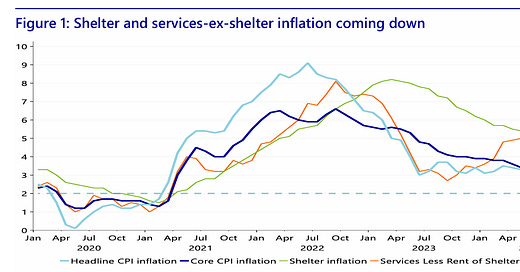

We expect a hawkish cut in December. This means a 25 bps cut, accompanied by indications that the FOMC is going to slow the pace of rate cuts in 2025, both in the dot plot and the press conference.

We still expect only one rate cut of 25 bps in 2025. However, because of the recent data, we now expect the FOMC to wait until March, instead of continuing in January.

We continue to expect a rebound in inflation once Trump raises tariffs on a wide scale. For the Fed, this means that they will have to pause the cutting cycle during the course of 2025.

Continues at bottom…

News/Analysis:

Equity Recap:

US equities retreated on Tuesday ahead of the Fed's next rate decision on Wednesday. Large caps bested small caps: S&P 500 (-0.39%) vs. Russell 2000 (-1.18%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.24% and 0.16% respectively.

Market News: Cars, Banks, AI Energy

"Japanese automakers Nissan Motor and Honda Motor reportedly plan to enter into negotiations for a merger to better compete in the rapidly changing global automotive industry, the Nikkei newspaper reported Tuesday. Honda and Nissan are considering operating under a holding company, and soon will sign a memorandum of understanding, according to the report. They also look to eventually bring Mitsubishi Motors, in which Nissan is the top shareholder with a 24% stake, under the holding company." Source: CNBC

"Bank of America Chief Executive Officer Brian Moynihan said regulators need to re-assess and relax rules they set for banks in what could be the biggest change for the industry under a Trump administration. “Our industry needs to have a sober look at the right regulation,” Moynihan, 65, said in an interview with Bloomberg Television Tuesday. Ratcheting up capital requirements — the money banks are required to set aside as a cushion against unexpected losses and financial shocks — makes it harder for firms to spend money and lend, according to the CEO, who’s about to start his 15th year as head of the second-largest US bank." Source: Bloomberg- 1

"Hedge-fund firms such as Coatue Management that are known for investing in next-generation technology companies have lately been piling into a sleepier sector.WSJ

"Databricks... has quietly become one of the fastest-growing startups in Silicon Valley. Source: WSJ

"Salesforce will hire 2,000 people to sell artificial intelligence software to clients, CEO Marc Benioff said on Tuesday CNBC

Politics/Geopolitics:

"The IDF has approved plans for major strikes in Yemen and is prepared to act pending government approval", via Open Source Intel citing N12 News.

IRGC has reportedly tightened its control over Iran's oil industry, they now control as much as half of the exports, via Reuters citing sources.

Data on Deck: FOMC/ PCE

MONDAY, DEC. 16 S&P flash U.S. services PMI

TUESDAY, DEC. 17 U.S. retail sales

WEDNESDAY, DEC. 18 Housing starts 2:00 pm FOMC rate decision/presser

THURSDAY, DEC. 19 Existing home sales

FRIDAY, DEC. 20 PCE index Nov2

Final Market Check