Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: India: Gold imports surged to an all-time high in November

Premium: Goldman Analysis

Discussion: Indian Gold imports

Oil Getting Ripe to Rally?

Oil recently has been inching higher despite bearish Chinese demand backdrop. Why? "Maximum pressure on Iran" is the signal from Trump

Last time Donald Trump was president he drove down Iranian oil exports to close to zero as he exited the JCPOA Iranian nuclear deal and implemented maximum sanctions. A repeat of that would remove all talk about a surplus oil market next year leaving room for the rest of OPEC+ as well as the US to lift production a little. - SEB

Full analysis at bottom

Goldman Notes India’s Gold imports surged to an all-time high in November

In August of this year GoldFix wrote:

“Since 2022, India's gold demand has not appreciably fluctuated with gold price, whereas before 2022, it fluctuated frequently and usually in line with gold price changes. This change signals inelastic demand at a higher price replacing elastic demand at different prices.”

Price is no object for Indians…

Today, Goldman Sachs confirms our thesis

From their report:

We are currently tracking gold imports at $59bn in January-November 2024, 48% yoy higher than the same period a year ago on the back of stronger than expected festive demand. [ EDIT- In July 2024, the Indian government significantly reduced import duties on gold, lowering the total customs duty from 15% to 6%.] This marked the most substantial reduction in over a decade,

We thus raise our forecast for gold imports to $65bn (vs. $50bn earlier) for CY24. Based on the current tracking estimates, we raise our gold imports forecast for CY24 by $15bn (+0.4% of GDP)

Gold Imports Surged to All time highs in November…

Goldman’s Bottom line: India’s merchandise trade deficit rose to an all-time high of $37.8bn in November as gold imports scaled new all-time highs at $14.8bn likely driven by strong festive demand, aided by the reduction in import tariff on gold earlier.

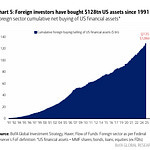

GoldFix Bottom Line: India, Like China, has moved decidedly to encourage gold ownership by its people through its fiscal decisions (lowering taxes for buyers) and its monetary policy (printing money to create inelastic demand)

Will this continue? Most likely Yes with seasonal exacerbation.

Full analysis at bottom…

News/Analysis:

Equity Recap:

US equities were mixed on Monday ahead of the Fed's rate decision on Wednesday. Large caps and small caps advanced: S&P 500 (+0.38%) vs. Russell 2000 (+0.64%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.55% and 0.33% respectively.

Market News: Trump-tomism

"CEOs of the world’s biggest companies are more optimistic about the economy than they have been in years. The enthusiasm is being driven in part by the prospect of President-elect Donald Trump’s return to the White House, with many chief executives expecting their businesses to benefit from lower corporate taxes and less regulation, according to a new survey. Outcomes of other elections around the world are also fueling expectations for improvements in the global economy and political stability. Executives are predicting a pickup in deal activity and easier access to capital in the coming months as well." Source: WSJ

"Nvidia shares slumped on Monday, putting the AI chip darling officially in correction territory even as the rest of the Nasdaq Composite rose to a record. CNBC

"Donald Trump and SoftBank Group CEO Masayoshi Son jointly announced Monday that SoftBank plans to invest at least $100 billion in U.S. projects over the next four years’ WSJ

"After topping $1 trillion in market cap on Friday and soaring 24% for its best day on record, Broadcom’s stock jumped another 11% on Monday, driven by increased price targets from Wall Street.CNBC

Politics/Geopolitics: Trump plays smartly

US President-elect Trump said he had a very good talk with Israeli PM Netanyahu, according to Reuters. He added it would not be pleasant if Hamas hostages were not released before he took office.

Proposed deal between Israel and Hamas calls for 60-day ceasefire, and for release of dozens of Israeli detainees in exchange for 700-1,000 Palestinian prisoners, via Sky News Arabia citing Israel Channel 14.

A senior Israeli official told Axios there were still gaps in the negotiations over the Gaza hostage and ceasefire deal "but they are all bridgeable", according to Axios.

US President-elect Trump says he is taking a look at TikTok and has a warm spot in his heart for TikTok, according to Reuters.

US President Biden's administration reportedly preparing a trade investigation into China's production of older semiconductors, according to NYT.

Russia may increase the frequency of missile testing as external threats grow, according to Russian state news agencies citing the commander of Russian strategic missile forces.

Russian lieutenant general Kirillov and his associate killed in explosion in Moscow, according to RT sources; Kirillov is listed as Chief of Radiological, Chemical and Biological Defence of Russian Armed Forces.

Senior US officials say Turkey and its militia allies are building up forces along the border with Syria, raising alarm that Ankara is preparing for a large-scale incursion into territory held by American-backed Syrian Kurds, according to WSJ.

Data on Deck: FOMC/ PCE

MONDAY, DEC. 16 S&P flash U.S. services PMI

TUESDAY, DEC. 17 U.S. retail sales

WEDNESDAY, DEC. 18 Housing starts 2:00 pm FOMC rate decision/presser

THURSDAY, DEC. 19 Existing home sales

FRIDAY, DEC. 20 PCE index Nov1

FINAL MARKET CHECK…