Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

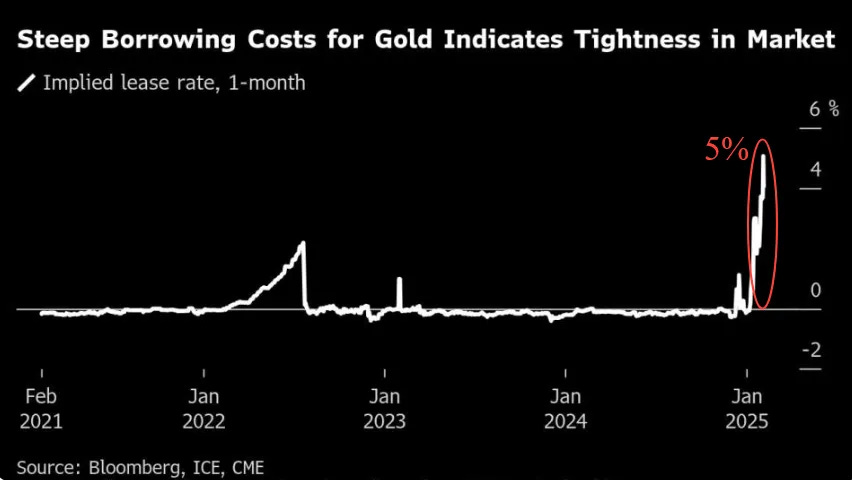

Discussion: Gold Lease Rates Explode as US Repatriation Grows

Premium: Gold Lease Rates Explode as US Repatriation Grows

Discussion:

Gold Lease Rates Explode as US Repatriation Grows

On January 30th we wrote about The Musical Chairs of Gold Supply

Bullion banks relied on a game of musical chairs, borrowing gold to meet short-term needs. But when enough chairs are removed—when buyers refuse to lease their holdings—banks are forced to compete for an ever-dwindling supply. That’s what’s happening now. From: Zerohedge Edit-The LBMA Doesn't Have the Gold

Yesterday, Bloomberg, in an article entitled Gold at Bank of England Trades at Discount as Tariff Fears Drive U.S. Demand describes the current gold market situation. The article states that:

‘Gold stored in the Bank of England (BOE) vaults is trading at a discount to the broader market as concerns over potential Trump tariffs drive a rush for physical bullion. The surge in demand has created weeks-long withdrawal delays, making BOE gold less attractive than metal stored in commercial vaults.’

The situation can perhaps be more aptly described using more (free) market-based terminology:

World Gold prices are higher than in England and therefore BOE Gold is being pulled out as world prices equalize higher. Logistics are perhaps being used to throttle demand instead of simply raising BOE prices.

In summary, the world currently wants its gold back with the USA currently leading the repatriation charge

More GoldFix analysis of that Bloomberg article again:

BOE Under Strain

The Bank of England, which holds over 400,000 gold bars worth $450 billion, is struggling to keep up with withdrawal requests. Much of the 8,000 tons of gold in London is locked up in central bank reserves, exchange-traded funds (ETFs), and long-term investor holdings, limiting the supply available for immediate trade.

The problem has been characterized solely as if the true global price is the BOE price, and the buyers are wrong here. Some would even say that the BOE logistics are throttling demand in hopes that prices equalize at the lower level sooner rather than later after the Gold rush is over. We are not saying that is happening.

The logistics problem is real. The LBMA and BOE, as responsible protectors of their market alsohad to know it was a risk given the events of the last 3 years including the Covid crisis, and multiple nations like India repatriating their Gold.

You simply cannot blame the customer for wanting to buy your product without raising eyebrows.

Time will tell when price equalizes between the two venues.

Full analysis: Gold Lease Rates Explode as US Repatriation Grows

Note: A deeper discussion on this topic including Gold Lease Rates as depicted in the chart above- and their implications will be recorded for premium subscribers this weekend.

News/Analysis:

Markets Recap:

US equities advanced on Wednesday as investors continued to assess a slew of corporate earnings reports. Large caps lagged small caps: S&P 500 (+0.39%) vs. Russell 2000 (+1.14%). MSCI Emerging Markets (EEM) slipped 0.25% and MSCI EAFE (EFA) gained 0.97%.

Market News:

“Arm Holdings gave a cautious revenue forecast for the current period, adding to recent concern that spending on artificial intelligence computing is slowing... Bloomberg

“Google on Wednesday released the Gemini 2.0 artificial intelligence model suite to everyone.The continued releases are part of a broader strategy for Google of investing heavily into “AI agents” as the AI arms race heats up among tech giants and startups alike. Meta, Amazon, Microsoft, OpenAI and Anthropic have also expressed their goal of building agentic AI, or models that can complete complex multistep tasks on a user’s behalf.” Source: CNBC

“China’s antitrust watchdog is laying the groundwork for a potential probe into Apple’s policies and the fees it charges app developers, part of a broader push by Beijing that risks becoming another flashpoint in the country’s trade war with the US. Bloomberg

Geopolitics/ Politics

Israeli occupation forces stormed Balata refugee camp east of Nablus in the West Bank, according to Al Jazeera.

Israeli PM Netanyahu questioned what was wrong with the idea of allowing Gazans to leave, while he added that the idea should be pursued and done.

White House said US President Trump has not committed to putting US troops in Gaza.

US Defense Secretary Hegseth held a call with Panama's President Mulino and they agreed to expand cooperation between the US military and Panama's security forces. It was separately reported that the State Department announced that US government vessels can now transit the Panama Canal without charge fees although the Panama Canal Authority later said it has not made any changes to charge fees.

via Newssquawk

Data on Deck: Unemployment Rate

MONDAY, FEB. 3 PMIs

TUESDAY, FEB. 4 Factory Orders, Lots of speakers

WEDNESDAY, FEB. 5 PMI, more speakers

THURSDAY, FEB. 6 Productivity.. speakers

FRIDAY, FEB. 7 U.S. employment report Jan.175,000/ Jobs; 4.1%/ Rate1

Final Market Check