Housekeeping: Good Morning. The West is Now Buying Physical Gold

Gold Revaluation is happening (quite literally) before our eyes

Today:

Commentary: ANZ Bank Sees $2550 Gold by End of Year

Premium: ANZ Gold Report Full Break-Down

Equity Recap:

US equities rallied on Tuesday after the producer price index report showed cooler than expected inflation, and ahead of the consumer price index report out tomorrow.

Premium Markets:

ANZ Bank’s latest on Gold was posted yesterday.

The Fed’s cutting cycle, when it begins, will attract strategic investment in gold. We have lifted our year-end price target for gold to USD2,550/oz.

Central bank purchases and physical demand continue to provide a strong base for gold demand.

Easing monetary policy to give the final push

We are approaching the start of the Fed’s rate-cutting cycle.

Strategic investment is coming back

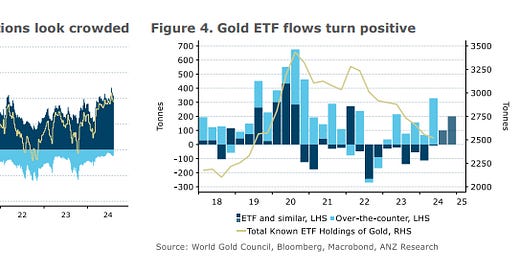

OTC Physical: Investments in gold in the over-the-counter (OTC) market increased to 329t in Q2 2024, the highest since Q4 2020.

A seasonal lull in physical demand

Demand has been surprisingly resilient to rising prices in the past 18 months. Total demand reached 3,071t in 2023 and hit 1,115t in Q1 2024.

Central bank buying still healthy

The People’s Bank of China (PBoC) made no purchases in July for the third month in a row. The Reserve Bank of India has become the second largest buyer of gold after Turkey (45t) with purchases of 37.3t in H1 2024.

A key resistance at USD2,480/oz

The key resistance at the record high USD2,480/oz needs to be breached for prices to move in the range of USD2,500–2,600/oz.

ANZ Bank Metals Scorecard Excerpt

Full analysis, report and grid breakdown in premium at bottom…

Market News:

"A rare bid to break up Alphabet’s Google is one of the options being considered by the Justice Department after a landmark court ruling found that the company monopolized the online search market... Bloomberg

"Home Depot has slashed its outlook for sales, the latest sign that US consumers are pulling back at a time of high interest rates.: FT

"It’s every CEO’s nightmare: not just losing that lucrative job but then watching his or her company’s share price rally on the announcement. WSJ

"A key measure of wholesale inflation rose less than expected in July, opening the door further for the Federal Reserve to start lowering interest rates. CNBC

"Elliott Investment Management plans to nominate a slate of candidates for Southwest Airlines’ board, escalating the activist investor’s push for sweeping changes at the struggling carrier. Bloomberg

"In just 10.5 minutes, Zeekr’s new batteries can go from a 10% to an 80% charge, using the automaker’s ultra-fast charging stations, the U.S.-listed electric car company said Tuesday. CNBC

"A week-long rally in crude oil, driven by a supply shortfall, eased on Tuesday as the west’s energy watchdog forecast that global inventories would grow next year. Source: FT

Politics/Geopolitics:

"Hamas will not participate in Doha's ceasefire talks tomorrow, according to a senior official in the Palestinian factions, who was cited by Al-Mayadeen", according to Walla's Elster

Support is reportedly increasing in Israel for an offensive against Hezbollah, according to WSJ.

Iran is reportedly planning to resume testing nuclear bomb detonators and is actively working on the development of its clandestine nuclear weapons program, getting closer than ever to building a nuclear bomb, according to Iran International.

Russia's border region of Belgorod declares regional emergency because of attacks by Ukrainian forces, according to the regional governor.

Ukraine plans to hold its first follow-up international conference after the peace summit online in August in which the conference is to focus on energy security, according to the presidential office.

It was separately reported that a US official said the objective of Ukraine's Kursk invasion appears to be to force Russia to pull troops out of Ukraine to defend Russian territory against this invasion.

Some headlines via NewSquawk or DataTrek

Data on Deck: CPI, PPI, Housing Starts

MONDAY, AUG. 122:00 pm Monthly U.S. federal budgetTUESDAY, AUG. 13Producer price index JulyWEDNESDAY, AUG. 14 CPI year over year 3.0% 3.0% 8:30 am

THURSDAY, AUG. 15 8:30 am Empire State manufacturing survey Aug

FRIDAY, AUG. 16 Housing starts July 1.35 million 1.35 million 1

Final Market Check…

Premium: The West is Now Buying Physical Gold

Quite frankly.. Vincent’s commentary attached to this report pertaining to the growth of OTC demand and the inelastic demand of India (previously discussed in India Needs The Gold) is the most important revelation for longer term prospects you will read the rest ot the year.

***DO NOT SHARE THIS***