Housekeeping: Good Morning.

“All Gold is monetary Gold ”

Today

Discussion: Someone Wants the Gold in a Big Way

Premium: Someone Wants the Gold in a Big Way- Here's Why

Analysis:

Fresh All Time High and Quarterly Close

Gold closed the quarter high—March 31st—at all-time highs, which is an indication that more buying will come in. And that may happen today.

Someone Wants the Gold in a Big Way

Yesterday on the COMEX, open interest went up by approximately 65,000 to 70,000 contracts. The interesting thing about that was that over 45,000 of those newly executed contracts were in the April expiration.

We have a full explanation of this extraordinary event as well as the way to handicap what is most likely to happen next in premium at bottom.

Continues at Bottom…

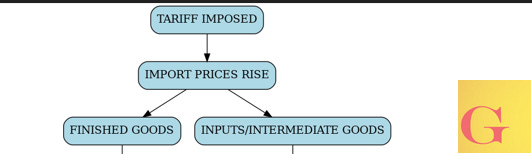

Tariffs Tomorrow

The only thing to would add is tariffs are supposed to be going into effect tomorrow. And while that could be a wild day for U.S. markets—stocks as well as gold—in either direction, the genie is out of that bottle.

And even if Trump pulls back, or Europe capitulates in some way—or even China (which I doubt would happen) capitulates—well, you’re now in a situation where tariff or no tariff, you're not interested in holding dollars any more than you have to.

Considering that tariffs are an anteroom to sanctions, if you were in the process of de-dollarizing before—and your trade with the U.S. is decreasing anyway—well, you're going to de-dollarize faster.

Chart at bottom…

Featured:

Gold Soars 4% in 5 Days — Here’s Why

Bank of America’s $3,500 Gold Thesis: Structural Demand, Policy Uncertainty, and the Currency Wars to Come

Markets Recap:

The S&P 500 and the Dow ended higher, as the benchmarks temporarily shook off the uncertainty around the Trump administration's upcoming tariff plans. Treasury yields were little changed, while the dollar inched higher. Oil prices rose amid supply concerns, and gold advanced on heightened safe-haven demand.

Market News:

ZeroHedge: "Tactical Tariff Thoughts"—JPMorgan's Trading Desk

Most investors are operating under the assumption that tariffs are temporary. Further, that a Trump Put is thought to exist in the 5,000 – 5,300 range for the SPX.

JPM's Andrew Tyler, head of JPM’s trading desk, the same one that called the Oct 22 low… writes that "policy uncertainty is the dominant factor in the markets and that neither the Trump Put nor Fed Put activate in the near-term."

Full Must Read Note: "Tactical Tariff Thoughts" here

Geopolitics/ Politics:

H/t Newsquawk for Geopol

Data on Deck: NFP

MONDAY, MARCH 31 PMI prep

TUESDAY, APRIL 1 PMI

WEDNESDAY, APRIL 2 Factory orders

THURSDAY, APRIL 3 Services PMI

FRIDAY, APRIL 4 U.S. employment report March140,000, 4.1% Powell speaks1

Summary and Final Market Check

Premium:

Someone Wants the Gold in a Big Way—Here's Why

COMEX Open Interest Surge in April Contracts

Yesterday on the COMEX, open interest went up by approximately 65,000 to 70,000 contracts. The interesting thing about that was that over 45,000 of those newly executed contracts were in the April expiration.

The reason that's interesting is because the April expiration, as of Friday, is now in liquidation mode. Expiration mode occurs on first notice day. First notice day is the day after which, if you are long the contract, you must indicate your intention—and prove your ability—to finance taking delivery of that contract. If you do not declare your intention, you risk your contract being liquidated without notice.

If you declare your intention, then you must pony up the money to make delivery between first notice day and expiration day, which, I believe, is April 28th this month.

Futures vs. Physical: What the Spike Could Mean

The reason the open interest increasing is so significant after first notice day is because, generally speaking, futures contracts are where directional speculators play, and physical contracts are where the deeper-pocketed players play.

For the open interest to increase—essentially double—on a day where it's supposed to start decreasing is an indication that someone either truly wants the gold, or is an extremely deep-pocketed player who intends to spoof the market higher.

Again, this is all against the backdrop that the data we viewed yesterday was actually accurate as published by the CME.

Now, the open interest in the April contract going up by over 49,000 contracts is indicative of someone saying: I would like to take delivery of 49,000 contracts. I have declared that intent, and I have the money to do so. To the best of my knowledge, I have never seen that happen in the gold market in my 30 years of experience. I have seen similar behaviors in other markets—oil and natural gas—but not gold.

Delivery Risk and Short Squeeze Scenarios

What could happen from here are any number of things, but the path forward will continue to narrow as each day goes on. So, for example, the purchaser of those contracts could just hold them, put the money up, and say: I want the gold. And between now and April 28th, whoever is on the other side of those contracts—the short—has to come up with the gold.

That could cause a literal short squeeze in the market if the short counterparties of that new long trade don't have access to physical metal.

The second thing that could happen is something that was done frequently in oil over the years from time to time: bullish players sense an undercapitalized short contract holder who is stressing—for one reason or another—to come up with the commodity. It could be an oil producer or a miner. It could be a bullion bank. It could be a hedge fund that's short and just hasn’t gotten around to covering yet. They're just hoping for that last second of profit.

And what happens in that situation is the bull buys the contracts going into first notice day, signaling three things:

He has the money to buy them,

He declares that he wants to buy them, and

You better have the commodity soon.

Then it becomes a game of pot bluffing. He has the money—he's proven it. He's declared he wants to take delivery. And you have to find the metal in this case.

The Short’s Options: Chairs Are Running Out

Now, the short can do one of three things, if this is the game being played:

They can have the metal, right?

They can—what's called—well, not reissue—they can go into the market and buy.

But this becomes increasingly difficult to do because the contract that they're looking to buy is in liquidation mode. And there are fewer and fewer people who wish to be sellers of a contract that, in 20 days, 15 days, 10 days, five days, will necessitate them having the metal.

So it becomes a pure replication of an analogy that I've been using here: it becomes musical chairs. And there are less and less and less chairs. And by April 28th, there are only two chairs left—or one chair left—and one chair is owned by the person who wants to take delivery. And the other chair, which is about to be pulled, is the guy who needs to come up with the metal.

So you could see how this becomes a game of chicken as we go toward April 28th.

Default Risk and the Long’s Exit Options

The third thing the short contract player can do is: they could default. And that has happened. You could also roll the contracts—but that's another conversation.

Anyway, at this point, the long who’s squeezing the short takes his profits by selling into the rally. Or he doesn’t take his profits and he takes delivery. Or he sells a deferred contract and puts on a spread for a credit or a profit.

So we’ve covered the first two things that the buyer can do:

The buyer can, (a) take delivery and say, I don’t care.

(b) Play like he’s taking delivery—and actually be able to take delivery if need be—but really what he's just doing is squeezing someone on the other side of the trade.

Or (c), he can sell out the next day.

But to be clear, selling out the next day would be incredibly risky for him. Because anybody who bluffs and then has their bluff called, and then changes their mind—the market will punish them. Like, potentially $100 lower punish them. And anyone who does that—who reverses a position like that after being fully vetted for the money, and after being fully vetted for the intent—well, they would open themselves up to investigation. That is straight-up manipulation.

Who's the Buyer?

Which brings us to the question: Who is the buyer? Nobody knows. But it’s not a tourist.

It could be a bullion bank. There’s a lot going on at the bullion bank level. There’s a rotation of shorts. There’s a covering of each other’s backs—all to keep the market orderly and to save their own asses.

There’s also—well, there are real whales out there.

Now, could this be China buying? I’ve heard that mentioned—taking delivery. It could be, but I doubt it. Could this be a U.S. Treasury taking delivery? Could be. Could it be a combination of people—some of which are serious, some of which are just piggybacking? Could be. Happens a lot in other markets.

However this plays out, it will signal a couple of things:

That the market is now good enough for people to consider manipulating it higher,

Or the market is big enough, and gold is important enough, that the bulls are equally—if not better—capitalized than the bears,

And the COMEX is turning into a physical market, completely replacing the LBMA.

LBMA Losing Grip and COMEX Rising

To note something that Tom Luongo said a couple of years ago to me: the removal of LIBOR and the replacement of it with SOFR on the rate front was the beginning of the end of European—or UK—dominance in the financial world.

Well, the LBMA squeeze—whether it be logistics, or because the bars are heavy, or because they simply don’t have unencumbered metal laying around (and they don’t—that’s just a fact)—that’s another conversation.

The power that the London Exchange—it's not even an exchange, it's the London Bullion Market Association, right? That’s what it is. It’s an association. That power is waning.

And the physical market is moving to the U.S. That’s where the gold’s going.

Anyway, stay tuned. That’s a cursory overview of how to view this. There will be more to come.

Every Day Counts

If you’re looking for a path from here and in: every day that the long of those contracts does not sell out is a day that the short of the contract must come up with it.

Possible Coordination Behind the Scenes

One other thing: my guess is the players knew this was coming. And while I wouldn’t call this pre-arranged, I would say that this is a situation where someone really wants to use the COMEX as a physical exchange. And in order to do that, you have to coordinate with other players.

“Hey, I’d like to take delivery of 49,000 contracts.”

“I’ll give you a year to do it.”

And the year goes up, and they’re ready to do it—and that’s what happens.

This is the nature of pre-arranged—legally—block trades and the over-the-counter market that work their way toward the physical market.

The Broader Market View

Anyway, let’s see what happens this quarter.

And moving on to the actual market itself: closed the quarterly high—March 31st—at all-time highs, which is an indication that more buying will come in. And that may happen today.

The only thing I would add to that is tariffs are supposed to be going into effect tomorrow. And while that could be a wild day for U.S. markets—stocks as well as gold—in either direction, the genie is out of that bottle.

And even if Trump pulls back, or Europe capitulates in some way—or even China (which I doubt would happen) capitulates—well, you’re now in a situation where tariff or no tariff, you're not interested in holding dollars any more than you have to.

Considering that tariffs are an anteroom to sanctions, if you were in the process of de-dollarizing before—and your trade with the U.S. is decreasing anyway—well, you're going to de-dollarize faster.

Have a good day.