Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: CPI/MUFG Commodity 2025

Premium: MUFG Commodity 2025

Discussion: MUFG Commodity 2025

Headline CPI is expected to rise by 0.3% in November

Core CPI is expected to rise 0 3% M/M and 3.3% Y/Y

The market and one prominent bank thinks CPI has to be super hot for the Fed to not cut 25bps in December now

Bottom Lines for Commodities:

Precious metals (bullish).

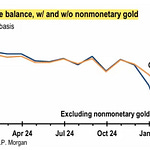

Gold –bullish.

Silver –bullish.

Energy (neutral-to-bearish).

Base metals (neutral-bullish).

Agriculture (neutral)

Top Trades

Long gold –“fear” and “wealth” dimensions offer compelling entry for our long gold call.

Long/short oil –upside on low valuations/Iran supply risks; downside on high spare capacity.

Short gas –upcoming mega-supply wave of LNG supply drive prices below lignite economics.

Full analysis at bottom…

News/Analysis:

El Salvador’s Gold Reserves Worth Up to $3 Trillion: President Bukele Highlights Economic Potential

Equity Recap:

US equities fell on Tuesday ahead of the consumer inflation report on Wednesday. Large caps and small caps retreated: S&P 500 (-0.30%) vs. Russell 2000 (-0.42%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) lost 1.61% and 0.90% respectively.

Market News:

"Taiwan Semiconductor Manufacturing’s sales rose 34% in November, reflecting sustained growth from AI demand despite concerns that data center building will slow. Bloomberg

"UBS plans to devote more attention and resources in the U.S. to affluent and not-quite-ultrawealthy clients, instead of just its typical focus of managing money for the world’s richest people.WSJ

"The next time you see a Hyundai online, you may just be able to hit Add to Cart. Assuming you want a new Hyundai specifically, you can now buy the car on Amazon. Wired

"Walgreens is in talks to sell itself to a private-equity firm in a deal that would take the pharmacy chain off the public market after its shares have been on a downward slide for nearly a decade. WSJ

"JPMorgan Chase said it now expects its net interest income haul to beat expectations for next year, reversing earlier guidance that analysts were being too optimistic...Bloomberg

"Investors’ “relentless” appetite for juicy returns has triggered the biggest boom on Wall Street in complex financial products since the lead-up to the global financial crisis in 2007. : FT

Politics/Geopolitics:

Israel to react strongly if new Syria regime lets Iran back in, according to Israeli PM Netanyahu.

Two US Navy destroyers successfully defeated Houthi-launched weapons while transiting the Gulf of Aden, according to the US military.

US is weighing harsher oil sanctions against Russia weeks before Trump returns to office, according to Bloomberg.

Russian Deputy Foreign Minister says Russia will "definitely be prepared to consider" another prisoner swap with the US, according to NBC.

Data on Deck:

MONDAY, DEC. 9 10:00 am Wholesale inventories

TUESDAY, DEC. 10 8:30 am U.S. productivity (revision)

WEDNESDAY, DEC. 11 8:30 am Core CPI

THURSDAY, DEC. 12 8:30 am Core PPI Nov.

FRIDAY, DEC. 13 8:30 am Import price index1

FINAL MARKET CHECK…