Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: What nuclear renaissance?

Premium: What nuclear renaissance?

Discussion: What nuclear renaissance?

“Whatever the goals, I take the Alchemists at their word: they are going to break something, I just don’t know what… whether it’s globalization, the Federal bureaucracy, the IRS, the FBI, Medicare, US vaccine policy (see page 15), lax US border policies, its “Deep State” opponents or something else.”

Wake me when we get there

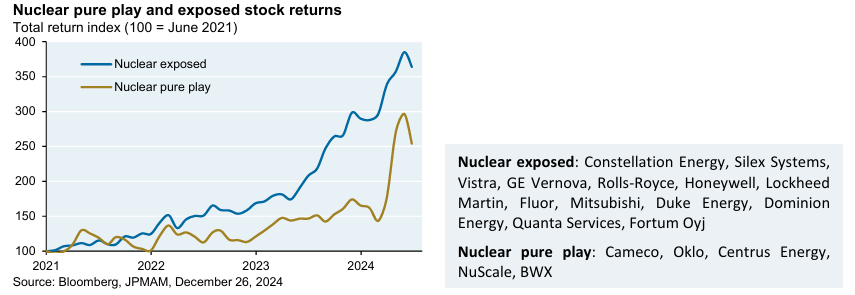

Investors have gotten excited about prospects for additional nuclear power in the US, driving shares of nuclear pure play and nuclear-exposed shares higher. There are several factors driving this enthusiasm: new US government regulations designed to speed up nuclear power development; the restart of decommissioned nuclear plants; the gaggle of companies competing to deliver next-gen nuclear plants and small modular reactors; and the Gates Terrapower project. Let’s take a look…

On Traditional nuclear plant development

While the developed world dominated nuclear additions from 1950 to 1980, a combination of factors led OECD nuclear additions to collapse. Since the 1990’s, almost all nuclear additions take place in the developing world.

Other Topics Covered include…

What about small modular reactors?

Next-gen nuclear designs

Nuclear plant reopenings

Will new US regulations make a difference?

Graphics and Data

US production vs imports of uranium oxide

Nuclear plants under development with estimated grid connection dates between 2024-2030

Capital cost of nuclear plants in developed countries vs emerging

During the 1980's, nuclear development shifted from developed to developing countries

Average nuclear plant completion time by year and region

Average mega-project cost overruns

Continues at Bottom…

News/Analysis:

Equity Recap:

US equities retreated on Thursday, weighed down by consumer discretionary (-1.27%) and materials (-1.14%). Energy (+1.04%) and utilities (+0.73%) outperformed the broader market indices. Boeing (-2.90%) and Nike (-2.64%) were the Dow's (-0.36%) worst performers; Nvidia (+2.99%) and Chevron (+1.29%) were the index's best performers.

Market News:

"The British pound fell to an eight-month low against the U.S. dollar on Thursday, while the euro hit its weakest level since November 2022. CNBC

"The rerouting of global trade from China to ports elsewhere in Asia is leading shipowners to move on from the era of ordering ever-larger vessels and switch to smaller crafts instead." Source: FT

"Initial applications for US unemployment capped 2024 at an eight-month low, reflecting the relatively muted levels of job cuts in a labor market that has remained surprisingly resilient. Bloomberg

"US mortgage rates climbed closer to 7%, threatening to squeeze buyers trying to crack into the housing market. Bloomberg

"Warren Buffett’s Berkshire Hathaway outperformed the S&P 500 in 2024 and pulled off its best year since 2021. CNBC

Geopolitics/ Politics

US President Biden decided to block the sale of US Steel (X) to Nippon Steel (5401 JT), according to The Washington Post.

US President-elect Trump named a team to work in conjunction with US Treasury Secretary nominee Scott Bessent with Ken Kies to be Assistant Secretary for Tax Policy and he named Cora Alvi as Deputy Chief of Staff.

US House Speaker vote is scheduled for today, NBC reports that the first call should begin at around 17:00GMT/12:00EST.

Israeli PM Netanyahu will convene a meeting today to discuss the mandate of the Israeli delegation that will leave for Qatar, according to Journalist Stein.

Israeli army noted sirens sounded in several areas of central Israel after a rocket was fired from Yemen, according to Sky News Arabia.

Sky News Arabia correspondent reported huge explosions in Syria's Aleppo amid Israeli raids

Data on Deck:

MONDAY, DEC. 30 Pending home sales

TUESDAY, DEC. 31 Case-Shiller home price index (20 cities)

WEDNESDAY, JAN. 1 New Year's holiday

THURSDAY, JAN. 2 Initial jobless claims, Construction spending

FRIDAY, JAN. 31 ISM manufacturing PMI1

Final Market Check