Housekeeping: Goldfix Weekly is different than the dailies. It is more like Barron's used to be. Content touches many markets with many types of content. The index helps. Thank you for reading.

SECTIONS

Market Summary— Bull mkt returns, Eth in play, Bonds

Week’s Analysis/Podcasts— 15 original pieces

Research— GS, MS, BBG , and Goldfix,

Charts— Silver takes cues from copper on bad gold days

Technicals— Gold, Oil, Nat Gas, Bitcoin

Calendar— Retail sales

Zen Moments— cat-dog, and horns

Full Analysis— Goldman on Commodity Re-rally

1. Market Summaries

Friday’s rally was especially memorable as it killed the bear market by definition1 and started a new Nasdaq bull market. It also sent the broader market up more than 3% for the week. That makes 4 weeks straight of rallies since Powell’s statement that the Fed was leaning towards neutral already. This is the longest stretch of gains since November.

Bottom Lines:

Stocks are supported by sidelined money that was bearish and/or hedging longs and now wanting back in the market. This is the same flow that caused Silver to rally recently and is akin to CTA money coming back into stocks. But it goes on further than metals these days since banks have broken metals futures markets with manipulation.

The stock rally will run out of gas organically when this type of reflation money is done buying, but it seems a long way from that yet based on Zerohedge’s flow analysis which is impeccable2 on these things.

What will stop this rally otherwise? Two main things.

First, the rally itself will stop the rally. The stronger stocks get the more likely Powell is to smack them back in place. With Powell trying to keep a cap on demand inflation, the more likely he will do something to stop it.

When earnings season comes around again, stocks will likely see disappointing earnings as profit margins get squeezed from consumers trading down to less expensive goods while corporate costs increase. That should put a dent in any rally.

The path forward is clear. The more the market rallies, the more likely the Fed will knock it down. If we do not get a 2nd data point of inflation backing off, then they will most certainly stomp on stocks. In the event the market drops precipitously with inflation weaker, only then will they act to stop that drop.

H/t Zerohedge for data and some graphics.

Sectors/ Technicals

S&P is now back over the 50% retracement level from the Jan all time high to the Jun bear market lows.

100DMA on the S&P far in the rearview mirror with the 200DMA looming

Meme stocks stormed higher as forced short squeezes sent the meme stock basket to the highest level in 5 months

Every sector was up for the week

Biotech was the weakest

Commodities:

Oil was choppy, Metals were very good as Gold got to the edge of the tormented teens.

A break above $1820 would be a very welcome opening Sunday night, but we hesitate to predict. Silver has done the work, Copper is keeping the base metals in line, and Oil remains semi-bid despite some bearish narratives now.

Bonds:

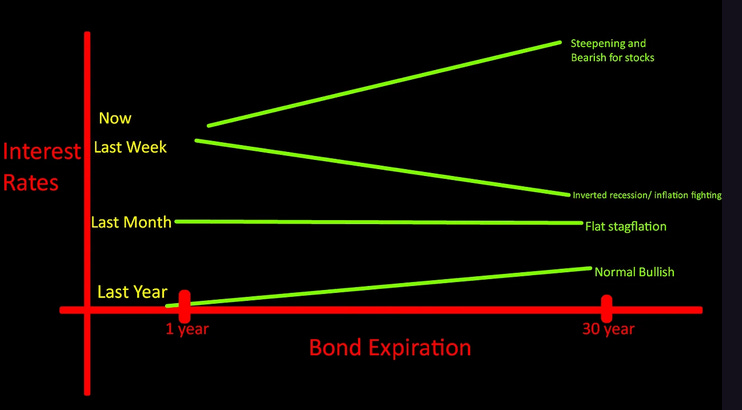

The Bond yield curve began re-steepening last week (courtesy in no small part of Fed QT), trying to undo some of it’s inversion. If this continues and pattern holds true; back end yields will climb and eventually this will hit stocks hard. We refer readers to our previous work on this if they wish to refresh on what the Fed’s M.O. will be for the foreseeable future

THE BROKEN BOND LADDER UPDATE

Inverted yield curves are almost always a recession indicator as we’ve written on several times going back to April. We are now in a recession by definition. The question is how bad will it get, or is this a very shallow one?

The answer lies in how quickly they get inflation down to 2%. We do not think that is likely at all given the state of Eu, Russia, and global trade; and have said as much. The goal posts will eventually be moved. When they get inflation to a low enough point (4%?) and the markets start to crack more, then they will declare victory and raise the target for inflation in our opinion.

Successful inversion kills inflation before it causes recession.

Inversion is also something that is caused by a Fed trying to fight inflation. So inversion both leads and leads to recession and disinflation. The analogy is exactly like giving a patient medicine (rate hikes and QT) to kill the (inflationary) disease before that same medicine eventually kills the economic patient.

So- how bad a recession do we get to get inflation under control? That is always the point. And that is where we see a problem.

The Fed is not actually reducing inflation. If it were, it would let the curve invert more. But it cannot, because the recession is coming too fast. So when the recession stuff happens, The Fed backs off hikes at the short and focuses on letting the long-end yields re-rise via QT. So if they are not actually reducing inflation, what are they doing?

They cannot get inflation to pre-covid levels again.

They are keeping a lid on short term inflation while encouraging what we already have to migrate out on the bond curve. They are moving much of the inflation around now. Some inflation is very baked-in and must be allowed to be reflected in long bonds. They are un-manipulating bond yields slowly.

They are letting inflation manifest in longer rates to work its way out of the system naturally. That is why they keep letting the yield curve ratchet higher at the back end. The new normal will be higher inflation, lower stocks, and high long term rates. The new normal will be.. the old pre QE normal.

How Can it End?

If they do it right, it will not be Armageddon for the economy. But it will kill another generation of small businesses and destroy wealth for retirees. Standard of living will seriously buy slowly drop for many. If they do it wrong.. then we get much worse inflation as QE comes back to rescue their error Here is a link to every GoldFix post on inversion if you'd like to read more: Yield Curve inversion and it's implications

Crypto:

Ethereum has an underlying bid that is patient, algorithmic, and not chasing yet. This is buying in anticipation of successful merge in mid September. Look for a spike higher as a sign that this order is filled. Then anything goes in either direction.

ETH Friday traded to a new 3 month high and is set to break above $2,000 this weekend, up more than 100% from its June lows.

2. Analysis/Podcasts:

This week’s Precious Metals, Energy, and Economics pieces by GoldFix

Popular Last Week:

JUST NOW: JPM Gold Traders Found Guilty! - 40,000 views

UNLOCKED War And Interest Rates- Zoltan Pozsar-35,000 views

Weekly: Payrolls Explode. What’s going on in the US economy?- 22,000 views

Oil and the Dog Days of Summer- By Brynne Kelly for Cornerstone Futures

UNLOCKED Weekly OilFix Podcast Excerpt- Oil Trading levels

Goldman Sets Table for the Next Bull Market Leg- Today’s Founders topic

JPMorgan on Bitcoin and Ethereum- JPM gets ready to recommend them

GoldFix Content Last Week: 15 original pieces

War And Interest Rates- Zoltan Pozsar- Just unlocked

Zoltan Pozsar: "A deep recession is the lesser of two evils" now- Zerohedge

Weekly: Payrolls Explode. What’s going on in the US economy?

Gold Trading Comment- making sense of recent behavior

Weekly OilFix Podcast Excerpt- Just Unlocked

Weekly Part I: Goldman Sets Table for the Next Bull Market Leg

Gold Futures for the Next 90 Days- Zerohedge

Goldman Not Backing Off Commodity Price Spike Belief | Market Rundown

JPMorgan on Bitcoin and Ethereum- must read for recent rally insights

Oil Podcast Test- More Moor

Recap Of The Biggest Crypto News In The First Week Of August

3. Research:

Goldman on Commodities with GoldFix markups

Morgan on “ The Brewing Storm”

Weekly Part I: Goldman Sets Table for the Next Bull Market Leg

The Snowballing US Rental Crisis Is Sparing Nowhere and No One- Bloomberg

Myrmikan Research excellent independent long piece on Russia, inflation, and many other topics we discuss here, but from a different perspective

Inflation not over at all. Covid stimulus is just unwinding

MORE AT BOTTOM4. Charts:

Gold:

Follows silver intraday, weaker, but above the teens it can run s long as Silver holds. Don’t get it confused with longs getting in. It’s shorts covering right now

Silver:

Outstanding performance moving independent of even when Gold isn’t complying more in line with Copper now. probably shorts still covering

Copper:

Whoever is buying Silver is also buying Copper. Likely China restocking of copper is also causing some short covering in Silver.

Oil:

Real supply is starting to be discounted in the market, but oil remains undecided in a big range

Caught Our Eye:

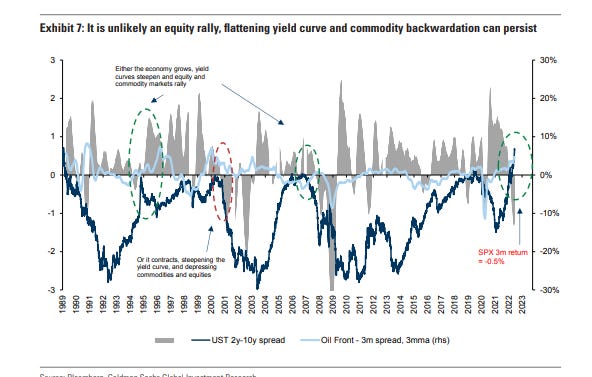

Goldman overlays backwardation in oil ( inflation) versus inversion (fighting inflation/recession) in bonds with stock performance stock performance

Charts by GoldFix using TradingView.com

5. Technicals

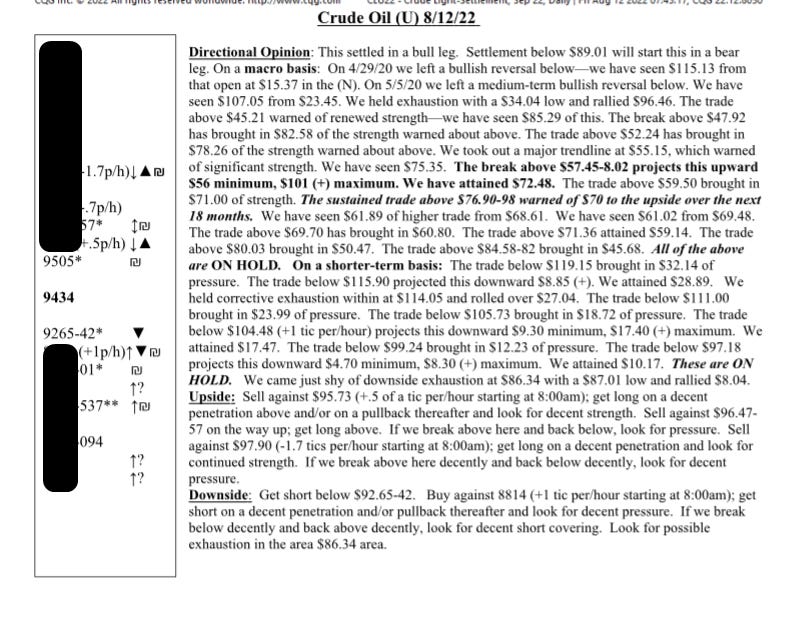

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold: Bullish above $1805.90

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Oil: Bullish above $89.01, bearish below $92.65

Nat Gas: Bullish above 8.064

Bitcoin: Bullish above 24130

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar

MONDAY, AUG. 15

8:30 am Empire State manufacturing index Aug. 5.0 11.1

10 am NAHB home builders' index Aug. 54 55

TUESDAY, AUG. 16

8:30 am Building permits (SAAR) July 1.70 million 1.70 million

8:30 am Housing starts (SAAR) July 1.50 million 1.56 million

9:15 am Industrial production July 0.3% -0.2%

9:15 am Capacity utilization rate July 80.2% 80.0%

WEDNESDAY, AUG. 17

8:30 am Retail sales July 0.1% 1.0%

8:30 am Retail sales ex-motor vehicles July 0.0% 1.0%

8:30 am Real retail sales July -- -1.0%

9:30 am Fed Gov. Michelle Bowman speaks

10 am Business inventories June 1.4% 1.4%

2 pm Federal Open Market Committee minutes

2:30 pm Fed Gov. Michelle Bowman speaks

THURSDAY, AUG. 18

8:30 am Initial jobless claims Aug. 13 265,000 262,000

8:30 am Continuing jobless claims Aug. 6 -- 1.43 million

8:30 am Philadelphia Fed manufacturing index Aug. -4.5 -12.3

10 am Existing home sales (SAAR) July 4.80 million 5.12 million

10 am Leading economic indicators July -0.5% -0.8%

1:20 pm Kansas City Fed President Esther George speaks

1:45 pm Minneapolis Fed President Neel Kashkari speaks

FRIDAY, AUG. 19

9 am Richmond Fed President Tom Barkin speaks

10 am Advance report on selected services Q2

Main Source: MarketWatch

7. Zen Moment:

Cat: Hide me, he’s coming Dog: where’d he go?

The NYC You Love to Hear