Housekeeping: Good Morning.

Today:

Premium Analysis: Why The UBS Target Raise is Important

Discussion: Why The UBS Target Raise is Important

Premium Analysis: Why The UBS Target Raise is important

Targets:

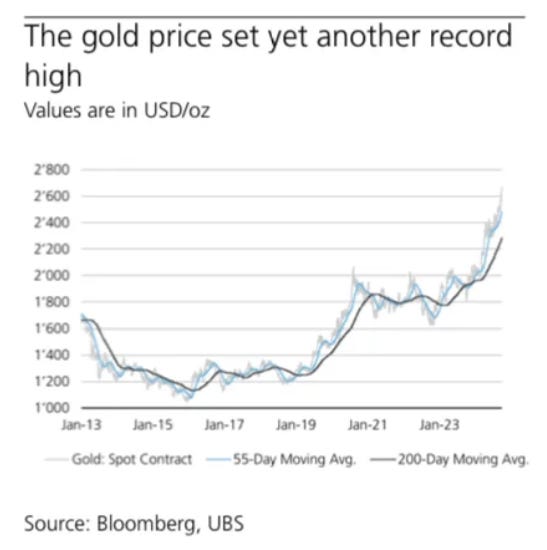

•2,750 by end-2024 from 2,600)

•2,850 by mid-2025 (from 2,700)

•2,900 by end-3Q25 (from 2,750)

From the report

Gold has risen by 29% this year, consistently breaking records on the way up. Meanwhile, the metal has risen above our long-held year-end target of USD 2,600/oz ahead of schedule. And according to the World Gold Council, it has historically rallied as much as 10% in the six months after the first Fed cut.

As such, we see even higher prices over the next 6-12 months, driven by greater investment demand alongside a drop in US real rates, a seasonal recovery in jewelry consumption, and ongoing central bank purchases. Overall, we recommend an allocation of around 5% to gold within a balanced USD portfolio and stay Most Preferred in our global asset allocation.

Full analysis here

Why it is Important: Western Europe is now buying Gold. This is a nascent movement, not just a recommendation. A movement to diversify out of EU bond risk and replace a portion of it with Gold.

After recommending Gold for Swiss Pensions, the WGC is recommending it to Ireland Direct Contribution pensions. This is a trend and will work its way into the Eurobond market’s heart. Dominoes are starting to fall in Europe.

That analysis at bottom

News Analysis:

Equity Recap:

US equities closed relatively flat on Friday, but the Dow Jones Industrial Average rose to a new record. Large caps lagged small caps: S&P 500 (-0.13%) vs. Russell 2000 (+0.67%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) lost 0.19% and 0.60% respectively.

Market News: Inflation down now, up later

The PCE price index, a measure the Fed focuses on to measure the cost of goods and services in the U.S. economy, rose 0.1% for the month, putting the 12-month inflation rate at 2.2% CNBC

"China said Sunday that it would allow home buyers to refinance their mortgages, the latest in a weeklong torrent of policy moves aimed at supporting the struggling economy. WSJ

"Key industry and government officials are urging US dockworkers and their employers to avoid a strike at East and Gulf coast ports this week, Bloomberg

"Apple is no longer in talks to participate in an OpenAI funding round expected to raise as much as $6.5 billion, WSJ

"Shigeru Ishiba’s election as leader of Japan’s ruling Liberal Democratic party is expected to put pressure on the country’s stocks on Monday morning after Nikkei 225 futures fell 6 per cent following his victory this week. FT

Politics/Geopolitics:

Middle East escalation continues. After first threatening direct involvement, Iran says they will not get directly involved in Lebanon. Full Geopol events footnoted1

Data on Deck: Unemployment

MONDAY, SEPT. 30 Chicago Business Barometer (PMI)

TUESDAY, OCT. S&P final U.S. manufacturing PMI

WEDNESDAY, OCT. 2 ADP employment

THURSDAY, OCT. 3 S&P final U.S. services PMI

FRIDAY, OCT. 4 U.S. employment report2

FINAL MARKET CHECK