Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: Where are Metals after Last Week's Stock Drubbing

Premium: At bottom

Discussion: Where are Metals after Last Week's Stock Drubbing

Backdrop: Stock Selloff

A month ago, Wall Street grasped the existential threat posed by China's DeepSeek technology—cheaper, more efficient, and a direct challenge to the AI-driven stock rally of the past two years. Analysts like Michael Hartnett and ZH flagged the risk, noting the market’s over extension.

We broke down Michael Hartnett’s coverage in China DeepSeek Turns Mag7 Into "Lag7"

Markets reacted sharply then—stocks tumbled. Yet, within four weeks, everything reversed. Equities surged as if DeepSeek never happened, and Wall Street moved on.Last week they remembered however….and stocks took a shot lower

That’s the backdrop, stocks might be headed face down in the mud. That should be Good for Gold right? Lets see what Michael Oliver says

Gold vs. S&P 500: Key Shift Underway

[paraphrasing]

The relative performance of gold against the S&P 500 has been in focus since 2020. Gold’s sharp rise in mid-2020 led to strong outperformance, followed by a pullback and a consolidation phase from mid-2021, where gold traded in line with equities.

Historically, when this spread breaks higher, gold tends to drive the move, rather than just weakness in stocks. The breakout level for this month is 48% or higher, and gold is already at 49.1% with a week left in the trading period.

This signals a clear shift in asset allocation, which is becoming more noticeable in market behavior.

Moving on to Silver…

Silver: Second time is the charm

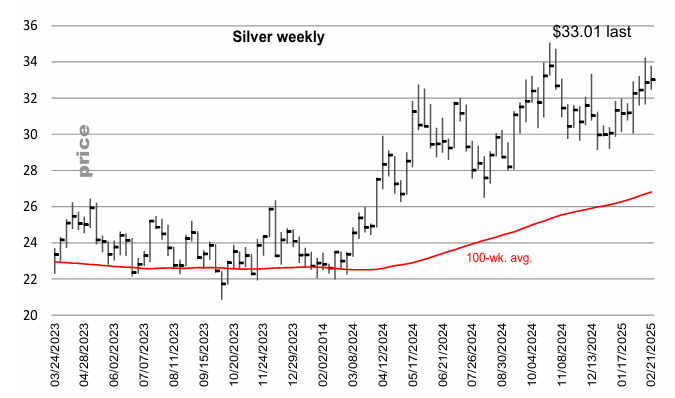

Back in March 2024 MSA issued a blanket bull trend resumption signal for gold, silver, and the miners based on long-term metrics including annual momentum.

Nothing has changed the positive direction of this momentum situation since.

The issue now is what price level do we need to see to signal another eruption and not merely an orderly drift higher?

His momentum indicator 100-wk. avg./zero line is rising weekly by about .10. To just trade up to that horizontal line on momentum this week requires a trade up to $35.30.

If you see a marginal new price high in the coming weeks, don’t assume it’s just another marginal new high in an arduous ongoing staircase. Expect something much more dramatic this time.

Bottom line is: The current recent high, when/if reattained will signal the end of the trading range

We hope to go through some of Michael’s miners tomorrow

News/Analysis:

Markets Recap:

US equities sold off sharply on Friday after data spurred concerns about economic growth and stubborn inflation. Large caps bested small caps: S&P 500 (-1.71%) vs. Russell 2000 (-2.94%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.29% and 0.62% respectively.

Market News:

Microsoft is canceling leases for AI data centers in the US, potentially reflecting concerns about overcapacity. ZH

“Warren Buffett says Berkshire Hathaway still prefers owning businesses. Berkshire’s chairman and chief executive told shareholders in his annual letter Saturday that while the company’s ownership of stocks declined last year, the value of the operating businesses it owns increased. Berkshire runs a range of subsidiaries in such industries as rail, utilities and insurance. A recent buildup in the Omaha, Neb., conglomerate’s mountain of cash and Treasury bills has drawn attention among investors.” Source: WSJ

“Billionaire investor Steve Cohen doubled down on his negative view of the U.S. economy due to a backdrop of punitive tariffs, immigration crackdown and federal spending cuts spearheaded by the Department of Government Efficiency. CNBC

“A high-level Japanese group that includes a former prime minister has drawn up plans for Elon Musk’s Tesla to invest in the struggling carmaker Nissan, following the collapse of its merger talks with rival Honda.” Source: FT

Geopolitics/ Politics: Minerals for Oil?

Ukraine Deputy PM said Ukrainian and US teams are in the finally stages of negotiations on the minerals deal; Kyiv is committed to complete the deal "as swiftly as possible".

Russia's Kremlin said "we welcome and support new US approach to dialogue with Russia". Russian President Putin is to make an international phone call this morning as part of informing partners about talks with the US. Further talks with US this week will focus on eliminating irritants in ties and on work of foreign missions. "Don't see any possibility to renew dialogue with Europe at the moment; European approach contrasts with the effort we are making with the US"

US President Trump said he thinks the US is pretty close to a minerals deal with Ukraine and that they are asking for rare earth, oil and anything they can get from Ukraine to recoup the money the US put into Ukraine.

China defended its recent naval drills in the Tasman Sea and accused Australia of ‘deliberately hyping’ military exercises.

via Newssquawk

Data on Deck: GDP, PCE

MONDAY, FEB. 24 None scheduled

TUESDAY, FEB. 25 S&P Case-Shiller home price index (20 cities)

WEDNESDAY, FEB. 26 New home sales

THURSDAY, FEB. 27 GDP

FRIDAY, FEB. 28 PCE 2.4% 2.6%1

Final Market Check