Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: Gambling is Very Bad For You

Premium: Silver’s Rally

Discussion: Silver Re-Starts

Bottom Lines:

As long as Silver is above the 200dma and Gold is above the 100 dma then Silver is a buy

If this is about relief for China (whether it be stimulus or Tariff relief) Silver is a buy relative to Gold

IF TRUMP COMES OUT AND SAYS THE WAPO STORY IS BULLSHIT… WE WILL REVERSE

What Happened: The Dollar got slammed and China’s markets recovered nicely. This was instigated by a story form WAPO stating Trump’s Tariffs are unlikely to be implemented as publicly discussed. Footnote for details1

MSA’s Michael Oliver Sunday Report on Silver:

Action has crafted a lovely three-point downtrend through peak weekly oscillator closes going back to September. Close out this week at $30.34 and action will close over that pivotal structure. If you see our defined breakouts by gold, silver, and the miners, you can assume the pullback/stall of the past few months is over. Buy low!

Michael on Gold:

For this week, a close at $2658.70 would clear the red horizontal and all closing readings since that early November “headline” selloff.

See video for more…

Gambling is Very Bad For You

After the introduction, Michael Cembalest discussed 6 topics of interest to him under the guise of the ghosts in Scrooge.…

I was visited by six ghosts recently, each one warning me of certain dangers. That’s the topic of this note.

Among the ghosts were apparitions warning of the hazards of: Predictions, Asset Allocations, Legalizations, Private Credit scam risk, Censorship and Self-Care.

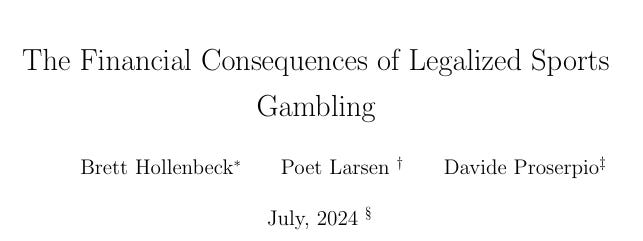

Our interest here is in the fourth ghost that visited him, the one warning about legalized gambling

The fourth ghost warned me that legalizing sports betting would end up having a noticeably negative impact on US households. He was right, particularly in states that allow online sports gambling.

The report he was referring to is entitled: The Financial consequences of Sports Gambling. Here is a key excerpt

Full analysis at bottom…

News/Analysis:

Equity Recap:

US equities rallied on Friday, led higher by tech shares. Large caps and small caps advanced: S&P 500 (+1.26%) vs. Russell 2000 (+1.65%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) added 0.93% and 0.44% respectively.

Market News: Trudeau Out Soon

Reuters reports that Canadian Prime Minister and the world's most iconic virtue signaling blackface, Justin Trudeau, is "increasingly likely to announce he intends to step down, though he has not made a final decision." The source spoke to Reuters after the Globe and Mail reported that Trudeau was expected to announce as early as Monday that he would quit as leader of Canada’s ruling Liberal Party after nine years in office. Following the news, odds that Trudeau would be out before April surged to 97% - - ZH

"US President Joe Biden has blocked a $15bn deal by Japan’s Nippon Steel to buy US Steel, delivering a setback to Washington’s relations with its closest Asia-Pacific ally and prompting the companies to threaten legal action." Source: FT

"SpaceX is significantly upping the ante of its Starship test flight program, with the next rocket launch expected to demonstrate payload deployment for the first time. TechCrunch

"Wall Street bankers are gearing up for a revival in initial public offerings as private equity groups seek to tap buoyant US equities markets to offload some of their flagship holdings. FT

"Productivity—the total output of the economy divided by hours worked—rose 2% in the third quarter compared with a year earlier...WSJ

"Microsoft plans to spend $80 billion this fiscal year building out data centers, underscoring the intense capital requirements of artificial intelligence. More than half of this projected spending through June 2025 will be in the US, Bloomberg

"General Motors and Ford both reported their best year of US sales since the pandemic scrambled the car market, as lower interest rates, higher inventory and deals persuaded shoppers to buy. FT

"Two Federal Reserve policymakers on Saturday said they feel the U.S. central bank’s job on taming inflation is not yet done, but also do not want to risk damaging the labor market in the process. CNBC

"Open-air neighborhood shopping centers are now one of the hardest types of commercial real estate to find space in. WSJ

Geopolitics/ Politics

Hamas said it approved a list of 34 hostages presented by Israel to be exchanged in a ceasefire deal.

Iran will face a difficult year with the Trump administration which plans to increase sanctions on Iran, while the Trump administration sees Iran as still a threat to US allies and the Trump team is considering the option of air strikes to prevent Iran from building a nuclear weapon, according to WSJ.

US is to ease aid restrictions for Syria in a limited show of support for the new government, according to WSJ.

Israel wants to keep some sites outside the northern border in Lebanon indefinitely, via AJA Breaking.

IAEA said staff reported hearing loud blasts near Ukraine's Zaporizhzhia Nuclear Power Plant on Sunday which coincided with reports of a drone attack on the plant's training centre, while the IAEA has not been able to confirm any impact and noted that reports stated there were no casualties and no impact on any nuclear power plant equipment, according to Reuters.

Ukrainian President Zelensky said security guarantees for Ukraine to end Russia's war will only be effective if the US provides them

Ukraine’s air force said on Sunday morning that it had downed 61 drones launched by Russia in an overnight attack.

Russia’s Defence Ministry said Russian forces took control of the Nadiya settlement in Ukraine’s Luhansk region, while it also announced that Ukraine launched a counter-attack in Russia’s Kursk region.

North Korea fired a suspected ballistic missile which was reported to have fallen shortly after and appeared to have landed outside of Japan's exclusive economic zone

Data on Deck: Unemployment Rate

MONDAY, JAN. 6 S&P final PMI

TUESDAY, JAN. 7 Speakers, ISM

WEDNESDAY, JAN. 8 Minutes of Fed's December FOMC meeting

THURSDAY, JAN. 9 Wholesale inventories

FRIDAY, JAN. 10 U.S. unemployment rate2

Final Market Check