Housekeeping: Good Morning.

“The reset is a process, not an event ”

Today

Discussion: Goldman Re-Raises to $3,700 with Views on $4,500

Premium: The USA:Goes From World Leader to Ripe for Looting

Analysis:

Goldman Re-Raises to $3,700 with Views of $4,500

Goldman Sachs has upgraded its 2025 year-end gold forecast from $3,300 to $3,700 per troy ounce, reflecting what it sees as a structural realignment of demand across three axes:

central bank accumulation,

ETF inflows linked to rising recession probability,

and investor positioning driven by macro volatility.

The Bank’s re-raise results in a material upward revision with surprises for several of those factors assessed in isolation as well as one low probability but plausible tail risk scenario (footnoted ) that combines all three in a perfect storm1

Full analysis in: Goldman Re-Raises to $3,700 with Views of $4,500

The USA: From World Leader to Ripe for Looting

The Hindustan times reported that India is weighing the import of gold, silver, and other precious metals from the United States as part of a broader strategy to narrow its bilateral trade deficit. According to sources familiar with the negotiations, the idea is being explored under the ongoing Bilateral Trade Agreement (BTA) discussions, which aim to integrate supply chains and introduce concessional duties on high-value trade items.

Implications of this:

Number One India seeks to rebalance trade by buying US goods. The only US good it's interested in is a commodity. This implies that we don't make anything they want to buy.

Full Story and Analysis in: From World Leader to Ripe for Looting

Featured:

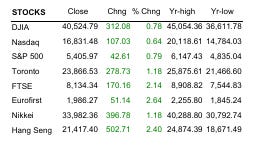

Markets Recap:

US: Stocks ended higher after the White House exempted smartphones and computers from the new tariffs. Treasury yields retreated after last week's surge and the dollar weakened as uncertainty around tariffs persisted. Gold fell, taking a breather from its record run. Oil prices were steady as strong China crude imports conflicted with weak global demand outlook.

Canada's main stock index rose with broad-based gains as investors welcomed the White House's exclusion of smartphones and computers from reciprocal tariffs against China. Toronto Stock Exchange's S&P/TSX Composite Index closed 1.18% higher at 23,866.53 points.

Market News:

PREVIEW- Bank of Canada is more likely to halt interest rate cuts after tariff pause

Tech, auto shares gain as Trump floats more tariff exemptions amid confusion

Goldman Sachs profit beats estimates as traders ride volatile markets

Nvidia to produce AI servers worth up to $500 billion in US over four years

Katy Perry launches into space with all-female crew on Blue Origin rocket

Full stories at bottom

Data on Deck: Retail Sales/ Housing

MONDAY, APRIL 14 6:00 pm Philadelphia Fed President Patrick Harker speaks 7:40 pm Atlanta Fed President Bostic speaks

TUESDAY, APRIL 15 8:30 am Import price index March 0.1% 0.4% 8:30 am Import price index minus fuel March -- 0.3% 8:30 am Empire State manufacturing survey April -10.0 -20.0

WEDNESDAY, APRIL 16 8:30 am U.S. retail sales March 1.2% 0.2% 8:30 am Retail sales minus autos March 0.4% 0.3% 9:15 am Industrial production March -0.2% 0.7% 9:15 am Capacity utilization March 77.9% 78.2% 10:00 am Business inventories Feb. 0.3% 0.3% 10:00 am Home builder confidence index April 38 39 12:00 pm Cleveland Fed President Hammack speaks

THURSDAY, APRIL 17 8:30 am Initial jobless claims April 12 -- 223,000 8:30 am Housing starts March 1.41 million 1.5 million 8:30 am Building permits March 1.46 million 1.46 million 8:30 am Philadelphia Fed manufacturing survey April 3.7 12.5

FRIDAY, APRIL 18 8:00 am San Francisco Fed President Mary Daly speaks2

Summary and Final Market Check

Premium:

Daily News